Please scroll down for digital banking information.

Introducing

Peak Credit Union™

On September 15th, 2025 TwinStar Credit Union and Northwest Community Credit Union will take the next step in our merger. We will be rebranding under one united brand and name: Peak Credit Union. This step will also include launching a new, united digital banking platform.

This page is your comprehensive guide to the launch of both the new brand and digital banking platform. We will continue to keep this page updated with information, graphics and videos of both the new brand and your new digital banking experience. Please check back frequently!

Our Story

In the heart of our communities, you'll find the true foundations of our strength. The teachers who inspire our children and the skilled millworkers who craft the very materials that shape our world. These are the founding members of TwinStar and Northwest Community Credit Union. People dedicated to building a brighter future, board by board, lesson by lesson. From sawdust trails to school hallways, from saving for a child’s future to securing a first home, we’re by your side. Our vision builds upon that foundation to cultivate a profound sense of belonging that resonates throughout our communities, as our membership evolved beyond wood products and teachers. Building community isn’t just a belief — it’s a promise. It's about recognizing the invisible threads that connect us all. When we belong to our community, we empower our members to transform financial stress into the freedom that serves as a building block for their dreams.

Peak Credit Union. Built for you. Built for belonging.

Conversion Schedule

This conversion only impacts online banking and the app. Debit cards, credit cards and checks continue to work, as well as cash back at branches and ATMs. You can also check balances via the contact center, Credit Union Connection or ATMs.

Digital banking (both the website and the app) will be taken down September 12th at 7 p.m. The new platforms will go live the morning of September 15th. Some functions, like ACH transactions, will be taken down at 12pm on September 12th. When the new platform goes live, you will be prompted to re-register your account. For security purposes, we could not migrate your password to the new platform, but you are able to re-use that same password if you prefer. Please remember to have any joint owners create their own login, read more about this change below.

Dates and Statuses

Other service disruption notices for September 12th - 15th.

| Branches | Open during normal operating hours |

| Contact Center | Open during normal operating hours |

| Credit Union Connection | Available |

| BillPay | Closed for new payment scheduling. Previously scheduled payments will process normally. |

| Debit Cards | Available |

| Credit Cards | Available |

| ACH Processing | Will Process Normally. New external transactions unavailable starting at 12 p.m. September 12th. |

| Physical Checks | Will Process Normally |

| ATMs | Available |

| Wire Transfers | Available |

| Quicken and Quickbooks (Intuit) | Unavailable 9/12 - 9/16 (relinking instructions are below) |

| Mobile Peer to Peer Payment Systems | Transactions will process from standalone apps. |

New digital banking and mobile apps

All members will need to download a new app that will be available September 15th. Links to those apps will be added to this page when they are available.

For members who access digital banking via a browser on a computer or phone, we will be launching a new, combined website under our new name, which will redirect you to the new platform.

New Features

Our new digital banking platform will feature the most up-to-date functionality available. There are lots of benefits we're excited for you to discover, some of the highlights are:

Account View and Shared Login

Joint and primary members will no longer share login credentials. Joint members will need to set up a new digital banking account following the steps below.

Tip: If you are a joint owner of one account but are a primary owner on another, you can simply use your primary account login credentials to access all of your accounts. To determine who the primary account holder is, view your statements (printed or digital.) The primary member is listed there.

The new platform will offer individual logins for primary and joint members. This upgrade will provide two critical benefits:

- Enhanced security through unique logins for each person

- Convenient access to all accounts for individuals with multiple memberships

In addition to the above benefits, it's important to note that all accounts associated with your Social Security Number will now display under one login. This is another critical reason for joint members to set up their own logins. It is the best way to ensure each person only has access to the accounts they are an owner of.

Business Member Impact

The above change to shared logins will also impact business members where their social security number (SSN) is the tax ID for their business. This is primarily for Sole Proprietors but may impact others based on how your business account is set up. For these members, you will see both your personal and business accounts under one login.

Other Key Impacts

- When the new digital banking platform is live on September 15th, members will be prompted to re-verify their account and set up a new password. This will also require new biometric login permissions.

- Digital banking will only display 18 months of history. For older details, please view your statements.

- Security and account alert preferences (as well as where you'd like these delivered) will not migrate. You will need to set these up once you reenroll.

Resetting a Quicken or QuickBooks Connection

With the updates to our digital banking platform, Quicken data connections will be disrupted from September 12, 2025 to September 16, 2025. You will need to reset your connection to online banking from within Quicken or QuickBooks after September 16.

The attached documents have been provided by Intuit to help you through this process. Our first action date is September 12 and the second action date is September 16.

Quicken and QuickBooks Conversion Instructions

What's Not Changing

- Account, member and routing numbers

(this means your current checks and automatic transfers will still work) - Debit and credit card numbers

(cards will be reissued with new artwork when they naturally expire) - Products you currently have

- Branch and ATM Footprint

- Our dedication to member support

Actions You Need to Take

- Prepare for digital banking downtime

- Download our new app on September 15th

- Log in with your existing User ID in our new digital banking platform (remember to have joint owners set up a separate login)

- Verify your security and account alert preferences as well as where you'd like these delivered (some settings will not migrate).

Logging in for the First Time

When the new platform is live, you will need to verify your account and set up your password the first time you log in. For security reasons, we can't migrate your password. The below process ensures your account is securely set up using the password of your choice.

For Primary Members

Complete the following steps the first time logging into the new platform.

- Click "log in" from our new website.

- Enter your credentials as you would in the legacy platform.

- Confirm your identity via Secure Access Code.

- Set up your password (This can be the same as your previous password, or a new one, as long as it meets minimum password standards.)

- Enjoy the new, upgrade digital banking platform!

For Joint Members

Complete the following steps the first time logging into the new platform.

- Click "log in" from our new website.

- Click “Enroll Now” at the bottom of the login page

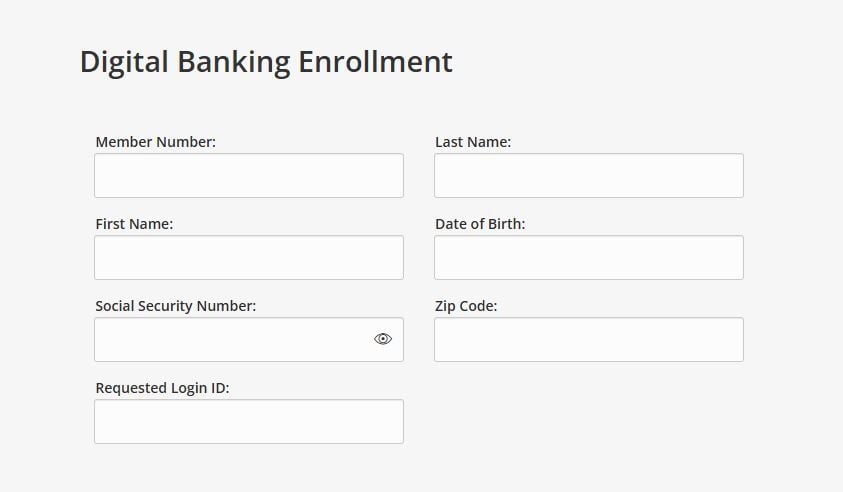

- Complete the digital banking enrollment form

- Digital Banking Registration Form

- Verify your account through the phone number on file for your membership

- Confirm or update your profile information

- Create a password using the listed requirements

- Review and accept the electronic agreement and terms of service

- Register your device (or choose not to if you are using a shared device)

- Enjoy the new, upgrade digital banking platform!

Finding Account and Routing Numbers

The new home page gives you immediate visibility to key account details like your account number. Watch the video to learn more.

More About Our New Brand

Why are we rebranding and changing our name?

Our merger presents a unique opportunity for our two organizations to come together. This merger has always been an equal partnership. Because of that, it doesn't make sense for one of our legacy names to "take over." This new brand represents not only who we have been and who we are, but also our vision for who we want to be, together.

What will have the new brand?

The short answer is everything! However, this transition will take some time for some things, especially our branch network. We will not remodel all branches immediately, but the signage will be replaced. While you should see the Peak brand replacing both NWCU and TwinStar in most places, some changes will take more time to be a comprehensive change.

Will you be reissuing new debit/credit/ATM cards?

We have a unique set of new card designs that represent our new brand. However, all debit, credit and ATM cards will only be replaced at their natural expiration date or when a card is reported lost or stolen. For cards that reissue at expiration date, your card number will not change and any automatic payments will not need to be updated!

Why did we choose the name Peak?

The name Peak was selected after an in-depth process involving a third-party creative agency and a committee consisting of members of our board of directors, CEO and President. The agency met with consumer and business members, employees and completed independent research on our legacy credit unions and the communities we serve. Based on their research, the creative agency proposed many names and the credit union committee selected Peak as our new name.

What will the new website be?

Our new website will be live at peakcu.org during conversion weekend.